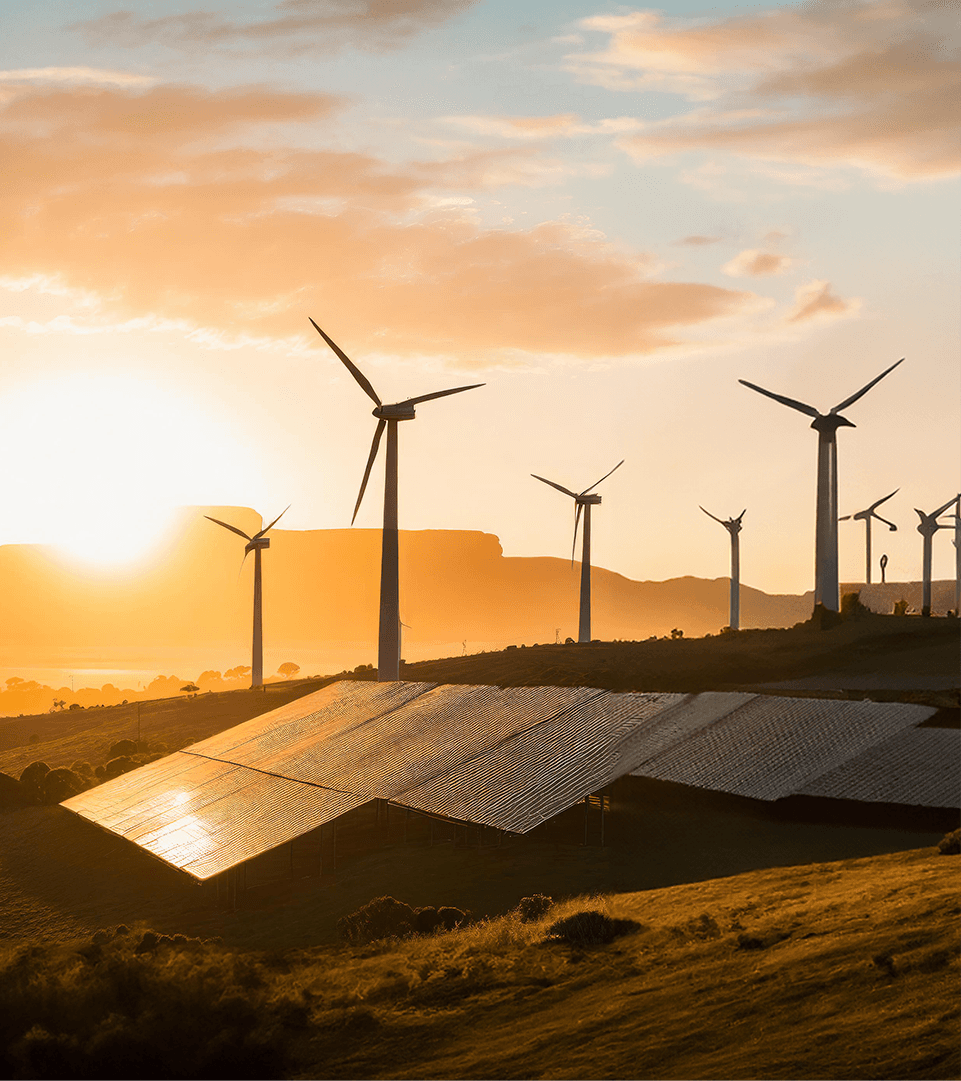

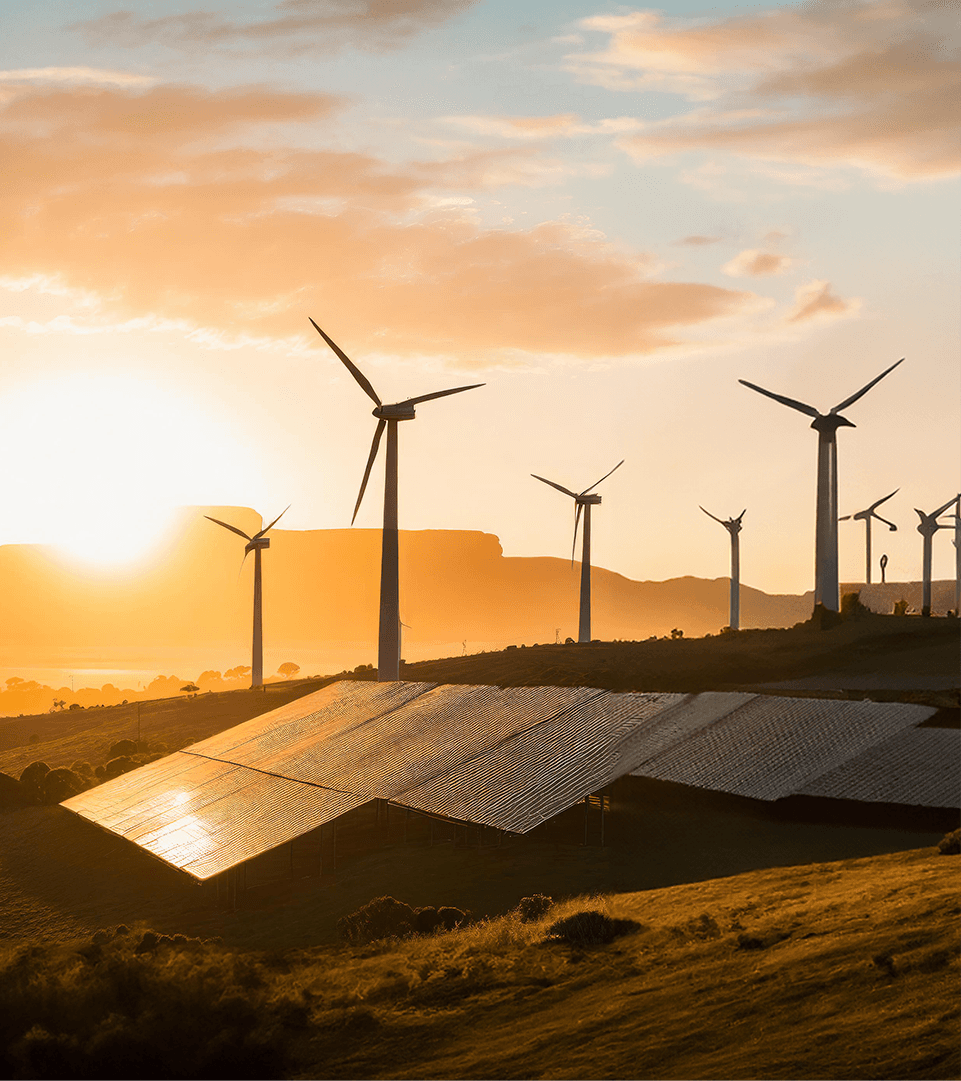

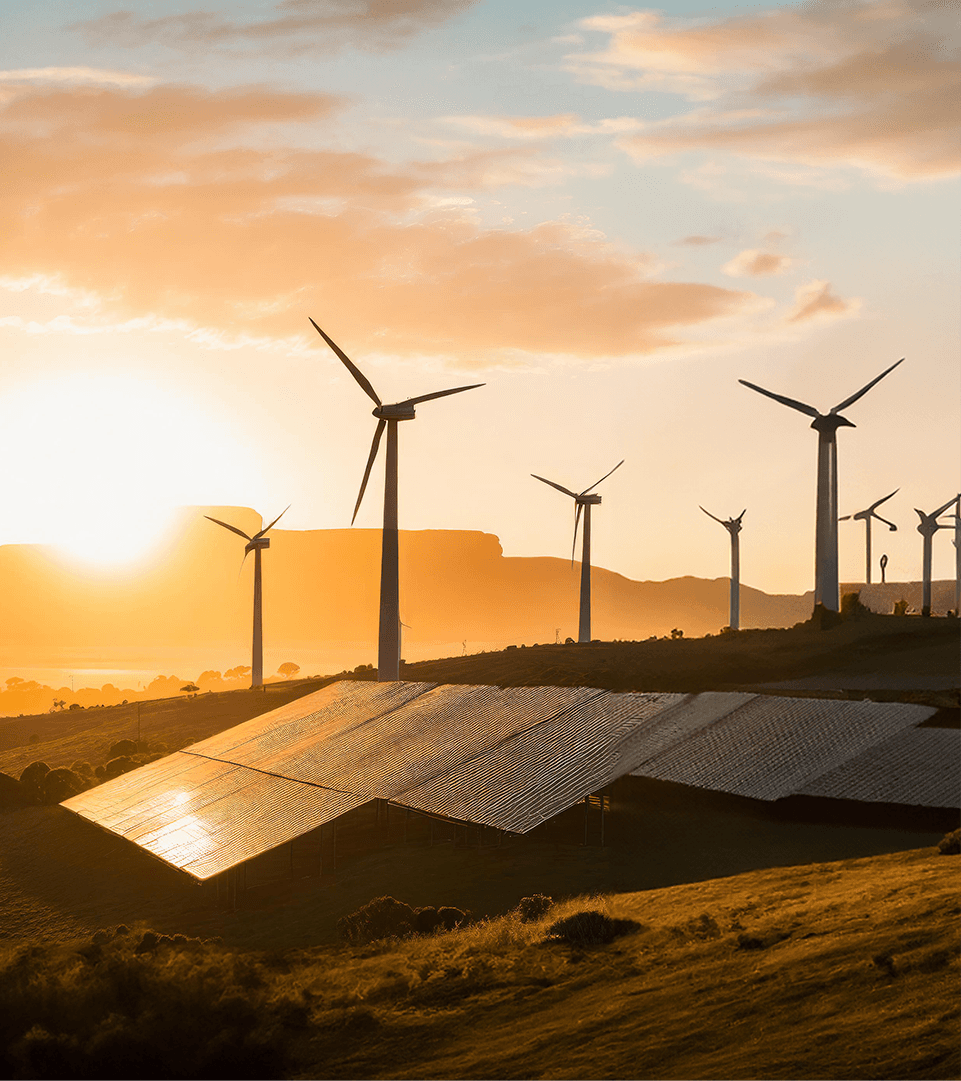

SECURE INVESTMENT FOR

FUTURE ENERGY PROJECTS

SECURE INVESTMENT FOR FUTURE ENERGY PROJECTS

AIF is a high-yield, alternative investment vehicle funding Solar projects. It brings projects to market and allows investors to access tax-leveraged investments. AIF's pipeline exceeds R200 million, and its partners comprise industry experts and reputable developers.

13% - 18%

AFTER TAX RETURN

13% - 18%

AFTER TAX RETURN

13% - 18%

AFTER TAX RETURN

INVESTMENT OPPORTUNITY

INVESTMENT

OPPORTUNITY

10%+

High annual returns with quarterly interim dividends and a final annual dividend

High annual returns with quarterly interim dividends and a final annual dividend

20%

20%

20%

Efficient equity share structure with only 20% dividend tax on distributions

Efficient equity share structure with only 20% dividend tax on distributions

4 + 1

4 + 1

4 + 1

Dividends paid quarterly and annually

Dividends paid quarterly and annually

Preferential investment opportunities in tax-leveraged projects

Preferential investment opportunities in tax-leveraged projects

Investment type

Investment type

Investment type

Ordinary shares

Ordinary shares

Ordinary shares

Minimum investment

Minimum investment

Minimum investment

R1 million

R1 million

R1 million

Recommended Term

Recommended Term

Recommended Term

This should be viewed as a medium-term, three-year investment.

This should be viewed as a medium-term, three-year investment.

This should be viewed as a medium-term, three-year investment.

Whilst shareholders may offer their shares for sale to the company at any time, there is no redemption right, and the repurchase of shares is subject to the company meeting the solvency and liquidity test.

Whilst shareholders may offer their shares for sale to the company at any time, there is no redemption right, and the repurchase of shares is subject to the company meeting the solvency and liquidity test.

Whilst shareholders may offer their shares for sale to the company at any time, there is no redemption right, and the repurchase of shares is subject to the company meeting the solvency and liquidity test.

Returns

Returns

Returns

13% - 18% targeted annual returns

13% - 18% targeted annual returns

13% - 18% targeted annual returns

Distribution policy

Distribution policy

Distribution policy

Dividends paid quarterly

+ final dividend paid annually

Dividends paid quarterly

+ final dividend paid annually

Dividends paid quarterly

+ final dividend paid annually

BackgRound

BackgRound

BackgRound

AIF offers private investors the chance to invest in a company that supports renewable energy projects in South Africa, particularly Solar Photovoltaic (Solar PV) projects. These investments are tax-effective and provide a reliable source of income.

Solar PV investments are attractive due to an unreliable power supply and ever-increasing electricity prices. AIF sources projects across the agriculture, commercial, industrial, and residential sectors, develop them and introduces taxpayer funding to take advantage of the special tax allowances in the Income Tax Act.

AIF offers private investors the chance to invest in a company that supports renewable energy projects in South Africa, particularly Solar Photovoltaic (Solar PV) projects. These investments are tax-effective and provide a reliable source of income.

Solar PV investments are attractive due to an unreliable power supply and ever-increasing electricity prices. AIF sources projects across the agriculture, commercial, industrial, and residential sectors, develop them and introduces taxpayer funding to take advantage of the special tax allowances in the Income Tax Act.

AIF offers private investors the chance to invest in a company that supports renewable energy projects in South Africa, particularly Solar Photovoltaic (Solar PV) projects. These investments are tax-effective and provide a reliable source of income.

Solar PV investments are attractive due to an unreliable power supply and ever-increasing electricity prices. AIF sources projects across the agriculture, commercial, industrial, and residential sectors, develop them and introduces taxpayer funding to take advantage of the special tax allowances in the Income Tax Act.

OBJECTIVES

OBJECTIVES

OBJECTIVES

•

To offer the opportunity to invest in the development and funding of solar projects across South Africa

•

Provide a targeted annual yield of 13% - 18%

•

To distribute regular quarterly dividends

•

Refinance existing projects to recover and

redeploy shareholder capital.

INVESTMENT OPPORTUNITY

INVESTMENT

OPPORTUNITY

ANNUALISED RETURNS

INTERIM DIVIDENDS

Q1

Q2

Q3

Q4

FINAL

DIVIDEND

ANNUALISED

RETURNS

2022 / 2023

2.5%

2.5%

2.5%

2.5%

13%

3% (actual)

2023 / 2024

2.5%

2.5%

2.5%

2.5%

5%

15% (actual)

2024 / 2025

2.5%

2.5%

2.5%

2.5%

5%

15% (projected)

Past performance is not necessarily an indication of future performance. Actual returns may differ depending on the date of investment, dividend reinvestment, and dividend withholding tax.

ANNUALISED RETURNS

ANNUALISED

RETURNS

INTERIM DIVIDENDS

INTERIM DIVIDENDS

2022

-23

2.5%

2.5%

2.5%

2.5%

2023

-'24

2.5%

2.5%

2.5%

2.5%

2024 -

'25

'25

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

2.5%

Year

Year

Q1

Q2

Q3

Q4

FINAL DIVIDEND

'22- 23

2022 - 2023

13%

'23-'24

2023 - 2024

5%

'24 -

2024 -

'25

2025

5%

5%

ANNUALISED RETURNS

ANNUALISED

RETURNS

ANNUALISED

RETURNS

'22- 23

2022 - 2023

23% (Actual)

23% (Actual)

'23-'24

2023 - 2024

15% (Actual)

'24 -

2024 -

'25

2025

15% (Projected)

15% (Projected)

Past performance is not necessarily an indication of future performance. Actual returns may differ depending on the date of investment, dividend reinvestment, and dividend withholding tax.

ENQUIRE NOW

ENQUIRE

NOW

Physical Address

1st Floor

Constantia Village Courtyard

Constantia Main Road

Constantia

Cape Town

7806

Physical Address

1st Floor

Constantia Village Courtyard

Constantia Main Road

Constantia

Cape Town

7806

Physical Address

1st Floor

Constantia Village Courtyard

Constantia Main Road

Constantia

Cape Town

7806

Postal Address

PO Box 44764

Claremont, 7735

Postal Address

PO Box 44764

Claremont, 7735

Postal Address

PO Box 44764

Claremont, 7735

Direct Contact

info@anuvainvestments.co.za

+27 21 683 0500

Direct Contact

info@anuvainvestments.co.za

+27 21 683 0500

Direct Contact

info@anuvainvestments.co.za

+27 21 683 0500

KEY INDIVIDUALS

KEY

INDIVIDUALS

CEO

Neill Hobbs

CA (SA)

Portfolio Manager

Portfolio Manager

Ryan Flowers

Finance Manager

Tarryn Walker

BCom Mgmt Accounting

Investment

Relations Manager

Investment

Relations Manager

Feroza Khan

Feroza Khan

CeFA® (UK)

Operations Manager

Keanu Lochner

Operations Manager

Marli Kriek

BA Environmental Mgmt

BSc. Honours in Geography

BA Environmental Mgmt

BSc. Honours in Geography

Investment

Consultant

Darryn van der Poel

BCom Finance/Economics

Investment

Consultant

Justin van der Poel

BCom Marketing

BCom Marketing

AIF (Pty) Ltd

Registration number: 2022/445205 /07

info@anuvainvestments.co.za

+27 (21) 683 0500

AIF (Pty) Ltd

Registration number: 2022/445205 /07

info@anuvainvestments.co.za

+27 (21) 683 0500

Physical Address:

1st Floor Constantia Village Courtyard

Constantia Main Road

Constantia

Western Cape

7806

Physical Address:

1st Floor Constantia Village Courtyard

Constantia Main Road

Constantia

Western Cape

7806

Postal Address:

PO Box 44764

Claremont

Cape Town

Western Cape

7735

Postal Address:

PO Box 44764

Claremont

Cape Town

Western Cape

7735

Copyright 2024 © AIF